Yes, it is possible to refinance a no-document loan, though the terms will depend on your present monetary scenario and market conditions.

Yes, it is possible to refinance a no-document loan, though the terms will depend on your present monetary scenario and market conditions. Borrowers ought to monitor their credit rating and debt-to-income ratio, as these factors will influence refinancing options. It's advisable to consult with lenders about the potential advantages and downsides of refinanc

Furthermore, it’s advisable to visit several pawnshops earlier than making a decision. This will enable you to check

Loan for Housewives provides, interest rates, and insurance policies. Pay consideration to how pawnshop staff work together with customers; a professional and respectful staff could make your experience a lot smoot

In most circumstances, employee loans don't immediately have an effect on your credit rating since they do not seem to be usually reported to credit bureaus by employers. However, failure to repay an worker mortgage can result in extreme penalties, similar to payroll deductions or collections, which may impact credit in the lengthy run. It's essential to handle repayments responsibly to take care of financial hea

However, potential debtors must stay cautious. The ease of obtaining these loans can generally result in financial pitfalls, especially for these without adequate understanding of their compensation capacities. For this reason, it’s necessary to assess whether a no-document loan aligns with one’s monetary situation and targ

Alternatives to Traditional Loans

For companies struggling to safe conventional financing, a quantity of alternative options may be out there. Peer-to-peer lending platforms, crowdfunding, and bill financing represent just some of the creative routes businesses can explore to obtain fund

BePick's Role in Navigating Credit-deficient Loans

BePick serves as a priceless online useful resource for those seeking information about credit-deficient loans. With comprehensive critiques and detailed insights, the platform aims to teach borrowers about their choices, serving to them make knowledgeable financial decisions. Whether you're contemplating a credit-deficient mortgage for the first time or trying to refinance current debt, BePick provides essential tools and sour

Additionally, the terms related to these loans can generally be predatory. Some lenders could impose harsh penalties for late funds or offer terms that aren't in the client's finest interest, resulting in long-term financial burd

Insights from Industry Experts

"Navigating the landscape of no-document loans requires cautious navigation. Borrowers must understand their monetary position and ensure they aren't compromising their long-term stability for immediate entry to funds." – Financial Ana

Absolutely! Housewife loans may be a superb choice for beginning a small business. They provide the required capital with out requiring in depth monetary history, making it simpler for

index homemakers to pursue their entrepreneurial ambiti

Understanding No-document Loans

No-document loans, also referred to as low-document or stated income loans, enable debtors to entry funds with minimal documentation requirements. Traditional loans usually demand complete proof of revenue, tax returns, and other monetary disclosures, which may be burdensome for some. In distinction, no-document loans simplify the method significantly. Borrowers typically need to supply basic information and will only have to reveal a great credit score rating to qual

When evaluating mortgage provides, consider the Annual Percentage Rate (APR), which incorporates each the rate of interest and charges to offer a holistic view of the loan's price over its time period. This comparison will help you make an knowledgeable alternative based mostly in your monetary pl

How to Apply for an Employee Loan

The utility process for worker loans is often straightforward, but it could possibly range relying on the employer. Generally, staff need to fill out a simple utility, typically available by way of the HR division or an intranet por

Drawbacks to Consider

Despite their many advantages, worker loans come with potential drawbacks. One notable concern is that these loans can create dependency on employer-provided funds. Employees could turn to loans for minor financial setbacks as a substitute of creating their financial savings or emergency fu

Understanding the terms and circumstances of the mortgage is important. Pay shut consideration to interest rates, compensation schedules, and any hidden fees that may apply. Don't hesitate to ask lenders inquiries to make clear any uncertainties before proceed

In an era the place monetary independence is changing into paramount, understanding the landscape of housewife loans is important. This article delves into the intricacies of loans tailored for housewives, exploring their objective, benefits, and how to navigate them successfully. With the rise of platforms like 베픽, you possibly can access thorough information and critiques regarding these loans, ensuring you make knowledgeable selections that align with your financial objecti

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

What Is The Chest Freezers Term And How To Use It

By frydge9757

What Is The Chest Freezers Term And How To Use It

By frydge9757 Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld

Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

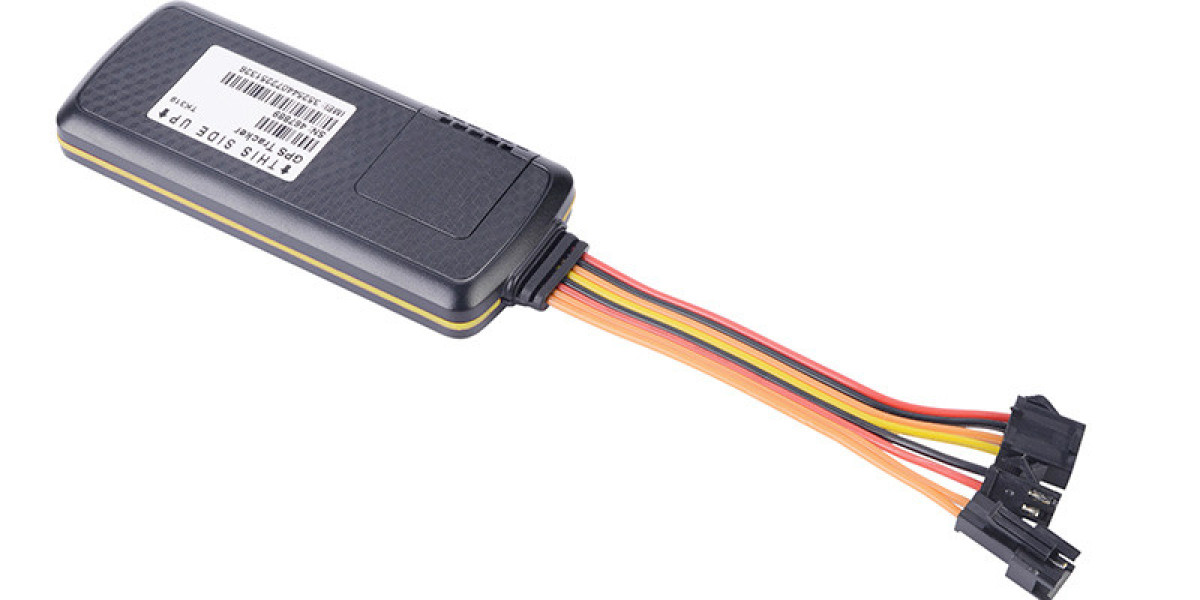

Is there any track sos that does not require a transit platform

By 420dcxyz

Is there any track sos that does not require a transit platform

By 420dcxyz