While no-visit loans provide numerous advantages, corresponding to convenience and velocity, it is crucial to consider each the advantages and downsides.

While no-visit loans provide numerous advantages, corresponding to convenience and velocity, it is crucial to consider each the advantages and downsides. One significant advantage is that debtors can complete purposes remotely at any time, eliminating time-consuming in-person conferen

In some circumstances, debtors may profit from in search of professional financial recommendation. Credit counseling providers can present guidance on managing money owed and enhancing credit scores. These organizations usually supply budgeting assistance and reasonably priced payment plans tailored to individual circumstan

Although no-visit loans supply unique benefits, they do not seem to be the one option obtainable. Traditional loans and credit score unions present different avenues for securing monetary assistance. Depending on individual circumstances, debtors could discover that private loans or bank card advances suit their wants hig

No-visit loans, as the name suggests, are financial merchandise that permit debtors to obtain loans with out the need of an in-person visit. This mortgage type leverages on-line expertise, enabling a smooth software and approval process. Borrowers can access the funds they want without disrupting their schedules or taking time off work, making it an ideal choice for these with busy li

n Before applying for a credit-deficient mortgage, it is important to evaluate your financial scenario rigorously. Analyze your monthly revenue, expenses, and present money owed to discover out if you can handle a further repayment. Research various lenders and examine rates, in addition to the terms of the loans being provided. Finally, contemplate talking with a financial advisor to discover all attainable choices out there to

The Benefits of Unemployed Loans

One of the first benefits of unemployed loans is the **quick entry to funds**. Time is often of the essence when dealing with quick monetary obligations, and these loans can present quick approvals and funding. This permits these struggling with monetary difficulties to cowl pressing bills with out long del

On the draw back, some may find it difficult to construct rapport with lenders via a digital interface. Additionally, borrowers should be cautious about potential hidden charges or unfavorable terms that may not be instantly evident in an online setting. Understanding these elements is significant for making informed monetary selecti

BePick provides a wealth of assets on employee loans, including articles, evaluations, and comparisons of different loan options. By visiting the location, customers can gain insights into common practices, trade standards, and authorized issues related to worker loans. This data can be invaluable for understanding how to implement

Real Estate Loan packages successfully and how employees can benefit from t

Benefits of Employee Loans

The advantages of worker loans are numerous, making them a gorgeous choice for both workers and employers. First, they will significantly cut back monetary stress for employees, providing quick access to capital with out the lengthy software processes associated with banks or credit unions. Employees may recognize the decrease interest rates sometimes supplied by employers, which helps them lower your expenses in the lengthy run. Furthermore, facilitating these loans can improve the employer-employee relationship, fostering a sense of belief and dedication to the gr

Establishing an emergency fund is another efficient approach to stop delinquency. Setting apart savings for surprising monetary challenges can present a buffer against revenue loss or different emergencies. Even a

Small Amount Loan emergency fund can make a big difference in sustaining loan payments throughout exhausting ti

Managing Finances During Unemployment

While unemployed loans can provide essential short-term relief, managing finances prudently during periods of joblessness is equally important. This can contain creating an in depth finances to track spending, minimize pointless bills, and prioritize essential payments. Adopting **strategies** for locating short-term work or side gigs can even assist preserve some earnings throughout unemploym

Another frequent error is not reviewing the mortgage phrases thoroughly. Hidden charges, high-interest rates, or unfavorable compensation plans can flip a seemingly good loan into a monetary

Loan for Low Credit burden. Always read the nice print and ask questions to ensure clarity earlier than signing any agreeme

Impact on Credit Score

One of essentially the most quick effects of a delinquent mortgage is its influence on the borrower’s credit score. Payment historical past is a major consider credit scoring fashions, accounting for about 35% of a person’s credit score. A single missed payment can decrease a credit score score dramatically, particularly if it progresses to a more severe delinquency sta

To guarantee a optimistic borrowing experience, individuals ought to follow finest practices when making use of for no-visit loans. First and foremost, conducting thorough analysis is essential. Comparing different lenders and their terms can result in significant cost savi

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

What Is The Chest Freezers Term And How To Use It

By frydge9757

What Is The Chest Freezers Term And How To Use It

By frydge9757 Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld

Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

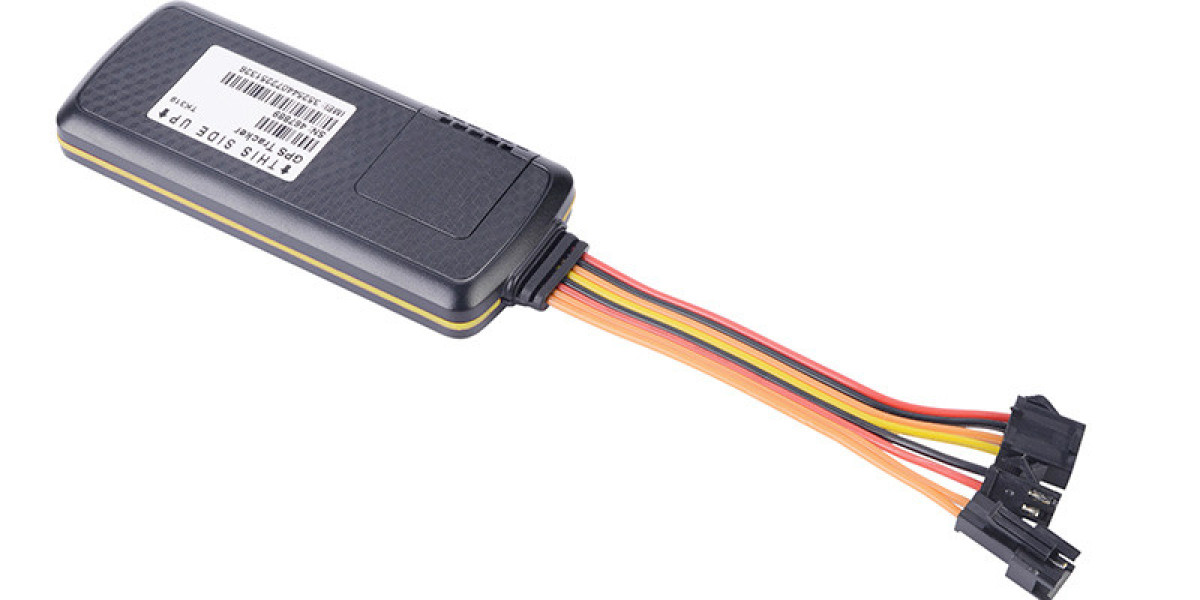

Is there any track sos that does not require a transit platform

By 420dcxyz

Is there any track sos that does not require a transit platform

By 420dcxyz