After submitting the applying, lenders will review the knowledge and will request extra paperwork. If accredited, debtors will receive the mortgage phrases, together with the interest rate, reimbursement interval, and whole amount disbursed. It is essential to read these terms fastidiously earlier than signing any agreem

Importance of Researching Lenders

With quite a few lenders offering freelancer loans, conducting detailed research is crucial. Not all lenders cater to the distinctive financial landscapes that freelancers function in; subsequently, finding one that specializes in freelancer financing is help

How to Apply for Unsecured Loans

The software process for unsecured loans can differ between lenders, but there are basic steps that borrowers can follow. Initially, it's crucial to evaluate personal monetary health, together with understanding credit scores and revenue ranges. This analysis permits borrowers to identify sensible mortgage options appropriate for his or her situat

Yes, a quantity of lenders focus specifically on freelancers and self-employed individuals. These lenders usually have extra versatile necessities compared to traditional banks. It's essential to research completely different choices and read critiques to find a lender that aligns along with your particular monetary wa

Another benefit is that small loans may help construct credit score. For borrowers who could not have a strong credit score historical past, responsibly managing a small mortgage and making timely repayments can positively impact their credit score rating. This opens doors for larger financing choices sooner or la

Lastly, unsecured loans do not require collateral, but this does imply that lenders may cost higher rates of interest to offset the chance. It's important to calculate the total value of borrowing and ensure it aligns with one’s price range before proceed

Drawbacks of Unsecured Loans

Despite their benefits, unsecured loans usually are not with out potential downsides. The most vital concern is the higher interest rates that sometimes accompany these loans. Since lenders face extra risks when lending with out collateral, they mitigate these dangers by charging elevated interest rates. This can result in increased financial strain on borrowers over t

Common Challenges for Freelancers

Despite the advantages that freelancer loans offer, freelancers often face challenges within the borrowing course of. One widespread obstacle is demonstrating earnings stability. Many lenders choose borrowers with conventional employment histories, leaving freelancers at a drawb

Understanding Freelancer Loans

Freelancer loans are particularly designed to meet the wants of self-employed individuals. Unlike traditional loans that require steady employment historical past, these loans contemplate various factors, including the freelancer's revenue potential and project history. This flexibility enables freelancers to access funds even when their revenue is inconsistent, permitting them to handle bills more effectiv

Many unsecured loans could come with fees corresponding to origination fees, late

Monthly Payment Loan charges, or prepayment penalties. It is essential to read the loan agreement rigorously and inquire about any hidden costs before finalizing the loan to avoid surprising pri

For these in search of reliable info regarding mobile loans, BePick stands out as a highly useful resource. This web site provides extensive evaluations, comparisons, and expert advice on numerous cell mortgage suppliers, giving customers

click through the following website page insight they should make educated financial choi

The utility process for a housewife loan tends to be easy, with minimal documentation required. Factors such because the applicant's credit history, the purpose of the mortgage, and the quantity requested can affect approval outco

The common interest rate for unsecured loans can differ widely based on components corresponding to credit score rating, mortgage amount, and lender insurance policies. Typically, charges might range from 5% to 36%, with individuals having glorious credit likely receiving decrease rates. Always examine multiple offers to find probably the most favorable r

One of the first advantages of a small loan is its accessibility. Unlike bigger loans, which can require intensive paperwork and a robust credit score historical past, small loans can often be secured with minimal documentation. This makes them an appealing option for people who're self-employed or wouldn't have a strong credit score rat

Several elements affect eligibility for a Credit

Emergency Loan, including credit score score, revenue stage, present debt-to-income ratio, and employment history. Lenders use these standards to assess your capability to repay the mortgage. Maintaining a healthy credit rating and a gradual earnings can considerably improve your chances of appro

The website is designed to information potential borrowers via the nuances of housewife loans, enabling them to make informed selections. With user-friendly navigation and insightful articles, BePick empowers users to equip themselves with the data essential to navigate their monetary opportunities successfu

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

What Is The Chest Freezers Term And How To Use It

By frydge9757

What Is The Chest Freezers Term And How To Use It

By frydge9757 Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld

Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

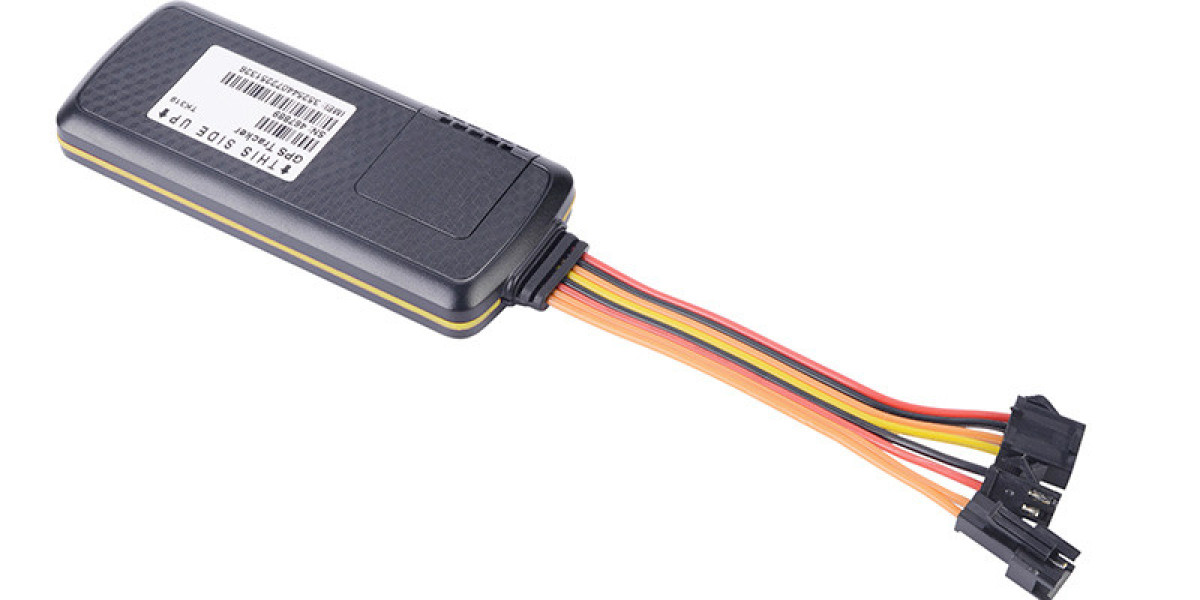

Is there any track sos that does not require a transit platform

By 420dcxyz

Is there any track sos that does not require a transit platform

By 420dcxyz