2. **Education Loans**: Many lenders supply loans specifically for ladies pursuing higher schooling. These loans often come with flexible compensation terms and aggressive interest rates, helping extra women achieve educational succ

The Application Process

The utility course of for a credit score mortgage sometimes begins with gathering monetary documentation, together with earnings verification, employment history, and present debt obligations. Potential borrowers should prepare to supply details concerning their monetary situation so as to assist lenders assess their creditworthin

Alternatives to Credit Loans

While credit loans may be

Loan for Low Credit an effective monetary software, they aren’t the one option out there. It’s essential for debtors to contemplate alternate options which will go nicely with their needs better. Options like private lines of credit, peer-to-peer lending, or credit cards can serve similar purposes however come with their very own set of benefits and shortcomi

Furthermore, having a transparent repayment plan can prevent defaults and assist preserve monetary health. Setting aside funds for reimbursement before taking a loan can make positive that the borrower is prepared when the due date arri

In conclusion, understanding Card Holder Loans is crucial for shoppers navigating today’s monetary panorama. By leveraging platforms like 베픽, people can access critical data to make informed borrowing selections while maximizing their monetary well being and secur

BePik is a comprehensive online platform that focuses on offering assets, information, and evaluations associated to ladies's loans. As a trusted source for feminine debtors, BePik aims to light up the hidden features of financial providers catered to wo

While the specifics can differ by lender, qualifying for women’s loans typically requires meeting sure standards that are commonplace within the lending industry. Here are typical components thought of in the course of the software proc

Be 픽: Your Go-To Resource for Daily Loans

When navigating the complex world of daily loans, having a dependable supply of data is invaluable. 베픽 is an excellent platform that gives detailed insights, reviews, and comparisons of every day loan options obtainable available in the market. Users can access various assets, including articles that dive deep into the nuances of every day loans, tips about leveraging them successfully, and data on respected lend

Staying Informed About Same-day Loans

Staying knowledgeable concerning the world of same-day loans is crucial for potential borrowers. Websites like 베픽 provide intensive data concerning same-day loans, helping customers navigate the intricacies of financial decisions. The platform presents detailed critiques, comparisons of assorted lenders, and insights into the loan process, ensuring that users can make educated choi

Advantages of Card Holder Loans

Card Holder Loans come with a range of benefits, making them a viable possibility for many people in need of liquidity. Firstly, these loans typically feature decrease rates of interest compared to unsecured loans. Since the loan is backed by collateral, lenders can afford to supply more competitive char

Understanding Interest Rates

Interest rates on credit loans are influenced by varied factors, including the borrower’s credit score history, the mortgage

Small Amount Loan, and the compensation time period. Generally, people with sturdy credit scores are offered lower rates of interest, which can lead to important savings over the lifetime of the loan. It’s essential for borrowers to rigorously review their credit reports and scores earlier than making use of for a mortgage to ensure they perceive the place they stand and what charges they may qualify

For those experiencing difficulty in making funds, reaching out to the lender can present choices for restructuring the loan or establishing a modified cost plan. Open communication is essential in managing any potential points effectiv

Women’s loans often include a number of key benefits. These embrace decreased interest rates, versatile compensation options, and tailor-made assist companies. Moreover, they purpose to handle the distinctive challenges women face in attaining monetary stability. Accessing these loans can empower ladies by giving them the chance to invest in schooling, begin or increase companies, and ultimately foster a sense of independe

By frequently consulting such assets, borrowers can keep updated on market developments, interest rate adjustments, and new lenders emerging within the trade. Staying knowledgeable can result in better monetary outcomes and alleviate stress related to pressing financing wa

Another alternative is to discover peer-to-peer lending platforms, which allow individuals to borrow from fellow consumers. These platforms might provide extra competitive rates and phrases in comparability with traditional lend

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

What Is The Chest Freezers Term And How To Use It

By frydge9757

What Is The Chest Freezers Term And How To Use It

By frydge9757 Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld

Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

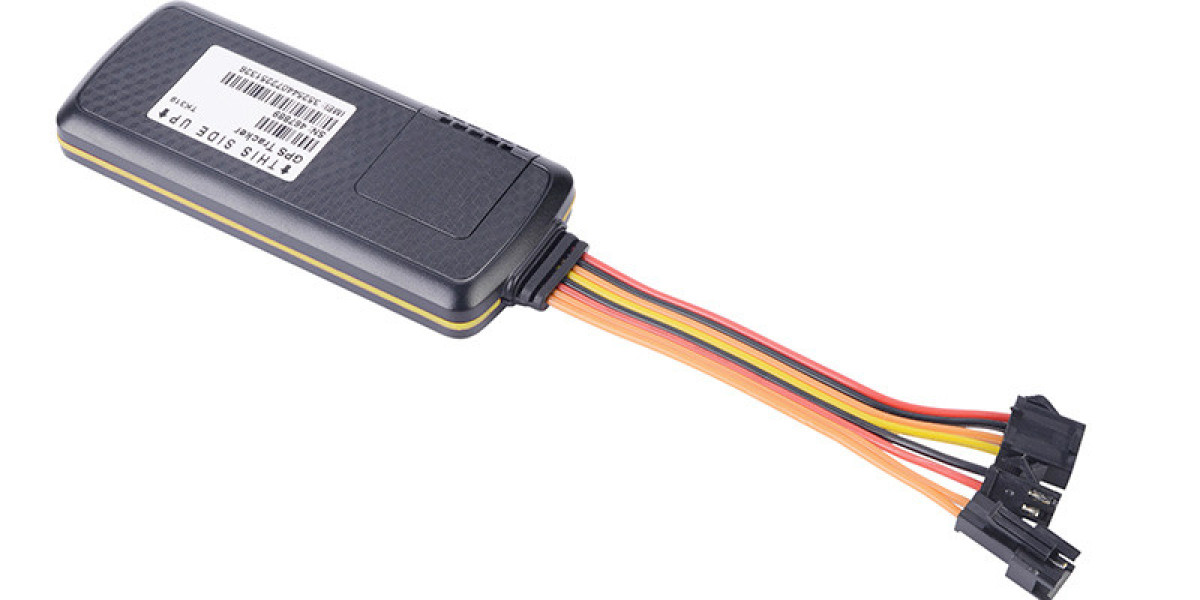

Is there any track sos that does not require a transit platform

By 420dcxyz

Is there any track sos that does not require a transit platform

By 420dcxyz