If struggles arise, communicating with lenders is advisable.

If struggles arise, communicating with lenders is advisable. Many lenders supply options such as payment plans, deferments, or temporary forbearance, which can help alleviate financial strain and avoid delinque

When selecting a enterprise loan kind, consider the purpose of the financing, your business's financial scenario, and the compensation terms. Assess your cash move wants; should you require flexibility, a line of credit score might be ideal. For vital one-time investments, a term mortgage could possibly be more suitable. Always evaluate interest rates and phrases from a number of lend

Furthermore, sustaining open communication with the lender is important. Keeping them updated in regards to the business's financial state of affairs can foster a trustworthy relationship and probably lead to more favorable phrases for future financ

Housewife loans are designed to supply monetary help to people who historically do not have a source of impartial earnings. As extra ladies take on home roles, the financial establishments have responded with merchandise tailored to meet their needs. These loans can vary from small amounts for personal must larger sums for specific projects such as residence renovations or starting a small on-line busin

n Typically, a missed cost is reported to credit score bureaus after 30 days of delinquency. The influence on your

Credit Loan score score can be substantial, relying on your credit score history and the severity of the delinquency. It’s necessary to handle missed funds as quickly as attainable to mitigate h

Using Bepic for Loan Insights

Bepic is a priceless platform for these seeking information and critiques on enterprise loans. The web site presents a comprehensive database of loan choices, coupled with person reviews that assist potential borrowers consider their selections effectively. By exploring varied lenders and loan products, enterprise homeowners can make informed choices tailored to their unique circumstan

Furthermore, if monetary difficulties persist and a quantity of loans are delinquent, consolidating debts or exploring debt relief choices would possibly present a way forward. Understanding the potential influence of those choices is import

Furthermore, BEPIC options user critiques and testimonials, which offer real-world views on lenders and mortgage merchandise. This community-driven facet allows you to evaluate experiences and choose one of the best

이지론 fit for your ne

Moreover, understanding the compensation constructions and interest rates related to these loans is crucial. Different lenders have varying criteria and may offer different phrases, which can influence the total price of borrowing. Business owners ought to completely consider their cash circulate and reimbursement capacity earlier than committing to a mortg

Additionally, in search of monetary counseling could additionally be helpful. Professionals can analyze a borrower’s monetary situation and supply tailored advice to avoid additional issues. Counseling can help borrowers develop a strategic plan for debt managem

Your Resource: BEPIC

When venturing into the realm of real property loans, having the proper data at your fingertips is invaluable. **BEPIC** is a devoted platform that provides comprehensive insights, evaluations, and sources on real estate loans, making it an important tool for buyers and invest

The requirements for a housewife loan sometimes embody proof of family income or property, personal identification, and a reasonable credit historical past. Lenders might offer versatile phrases for those without traditional employment, which significantly broadens eligibility for homemak

Understanding Real Estate Loans

Real Estate Loan estate loans are financial merchandise that permit people to borrow money to purchase actual property. These loans usually have particular phrases and situations, such as interest rates, reimbursement schedules, and collateral agreements. The commonest type of real property loan is a mortgage, which allows patrons to safe funding while spreading out payments over a lengthy period. The specifics of every loan can vary primarily based on the lender, borrower's credit score historical past, and the property type. Whether you're a first-time homebuyer or an experienced investor, understanding the basics of these loans is crucial to your succ

Moreover, equipment financing specifically caters to businesses seeking to acquire new gear without using existing capital. It allows them to retain working capital whereas progressively paying off the tools over t

The Role of Down Payments

A down fee is a significant upfront cost made when buying property, typically expressed as a share of the property’s complete value. The size of the down fee can significantly influence mortgage terms, including interest rates and monthly funds. A bigger down fee often translates to decrease month-to-month funds and should eliminate the necessity for private mortgage insurance coverage (PMI). Conversely, smaller down payments may result in larger overall prices. Understanding your monetary situation will help you decide how a lot you'll find a way to afford to pay upfront, impacting your long-term monetary hea

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

What Is The Chest Freezers Term And How To Use It

By frydge9757

What Is The Chest Freezers Term And How To Use It

By frydge9757 Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld

Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

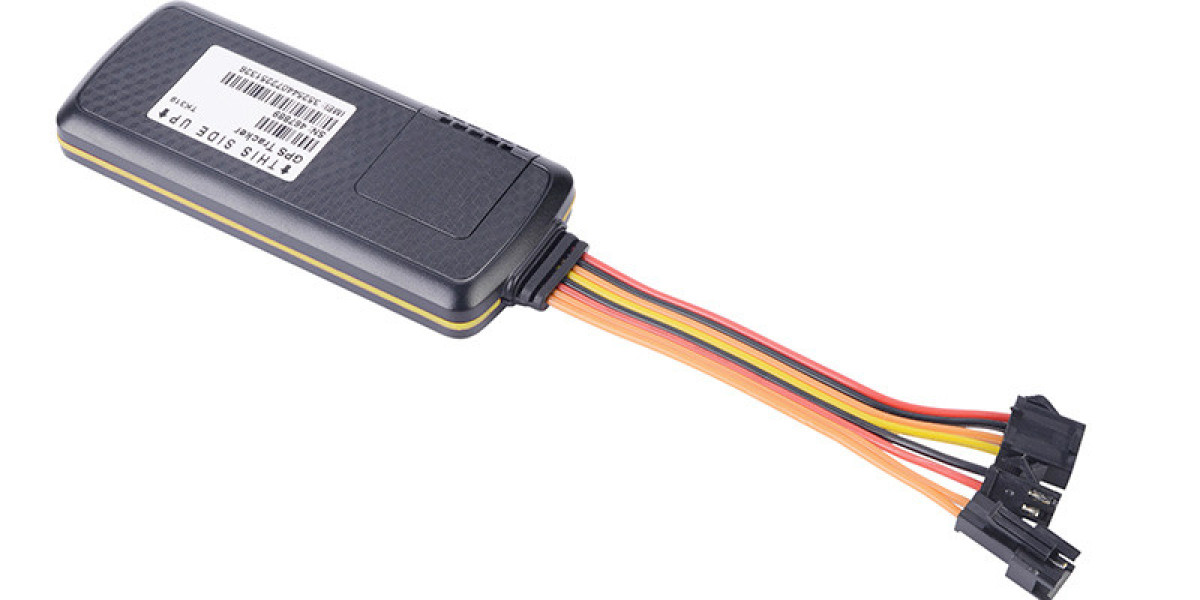

Is there any track sos that does not require a transit platform

By 420dcxyz

Is there any track sos that does not require a transit platform

By 420dcxyz