If more payments are missed, penalties often improve, probably leading to late charges and better rates of interest.

If more payments are missed, penalties often improve, probably leading to late charges and better rates of interest. The lender may also report the delinquency to credit bureaus, which might significantly affect the borrower’s credit score score. This score is essential for securing future loans or credit, so it’s crucial to act promp

Some lenders might supply promotional rates for a limited time, however it’s crucial to focus on what the speed will revert to after this era ends. An knowledgeable alternative ensures that debtors are ready for future fee obligati

In today's fast-paced digital world, accessing loans has turn out to be extra handy than ever, due to the appearance of Mobile Loans. These loans present quick monetary options via cell apps, making the borrowing process seamless and user-friendly. Individuals in search of private loans, small enterprise financing, or emergency funds can benefit from the convenience and accessibility offered by mobile lending platforms. However, knowing tips on how to navigate this panorama, understanding the dangers involved, and finding dependable data are essential steps for potential borrowers. This article delves into key elements of mobile loans while additionally highlighting the excellent resources available on the BePick webs

Additionally, continual delinquency can result in more extreme actions from lenders, such as the initiation of collections or authorized action. For secured loans, this would possibly even result in the repossession of property, such as autos or properties. It's a reality that debtors must face and perceive the potential trajectory if no action is taken to resolve the state of affa

n Yes, delinquent loans can typically be resolved through communication with your lender. Most lenders are willing to work with debtors facing difficulties by providing cost arrangements, deferments, or potential mortgage modifications. The sooner you reach out after experiencing fee difficulties, the higher your options could also

Benefits of Debt Consolidation Loans

There are a quantity of distinct benefits to pursuing a debt consolidation

Loan for Office Workers. One of the main advantages is **simplification of payments**. Instead of juggling multiple monthly funds, you only have one cost to handle, which may considerably reduce stress and enhance clarity in financial commitme

In addition to mortgage evaluations, BePick constantly updates users on the latest industry news, shedding gentle on market fluctuations, policy adjustments, and ideas for securing favorable

Loan for Delinquents terms. This wealth of knowledge is especially helpful for first-time homebuyers who may really feel overwhelmed by the numerous decisions obtainable available in the mar

Before making use of for a consolidation loan, it’s wise to examine your credit score report for errors and repay small money owed to enhance your overall financial profile. Preparing a complete monetary statement can also demonstrate to potential lenders that you’re serious about managing your debt successfu

Final Thoughts on Delinquent Loans

Delinquent loans can pose critical challenges for debtors. Understanding the implications and management strategies is crucial for avoiding long-term monetary repercussions. Open communication with lenders, sensible budgeting, and leveraging resources like BePick can considerably ease the stress related to delinquency and empower people to regain management over their financial fut

Additionally, debtors can take steps to improve their credit score score and lower interest rates by paying down debts, making timely funds, and sustaining a great credit score historical past. By doing so, borrowers can't solely qualify for better terms but in addition save substantial amounts over the life of the mortg

Types of Real Estate Loans

There are several kinds of actual property loans obtainable out there, every catering to distinctive needs and particular buyer profiles. Conventional loans are often favored as a end result of their standard phrases and rates, typically requiring good credit score and a large down cost. On the opposite hand, government-backed loans, similar to FHA and VA loans, offer more flexible qualification necessities, making them accessible to a broader audie

By consolidating debts, borrowers typically goal to secure a lower rate of interest than what they are presently paying on their separate loans. This can result in substantial financial savings over time, especially if bank cards or high-interest loans are involved. Generally, these loans could be obtained from banks, credit score unions, or on-line lend

The principal advantages of a debt consolidation loan embody simplified funds,

이지론 decrease rates of interest, and potential credit score score improvement. By combining a quantity of money owed into one mortgage, borrowers manage their funds more easily and will lower your expenses over t

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

What Is The Chest Freezers Term And How To Use It

By frydge9757

What Is The Chest Freezers Term And How To Use It

By frydge9757 Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld

Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

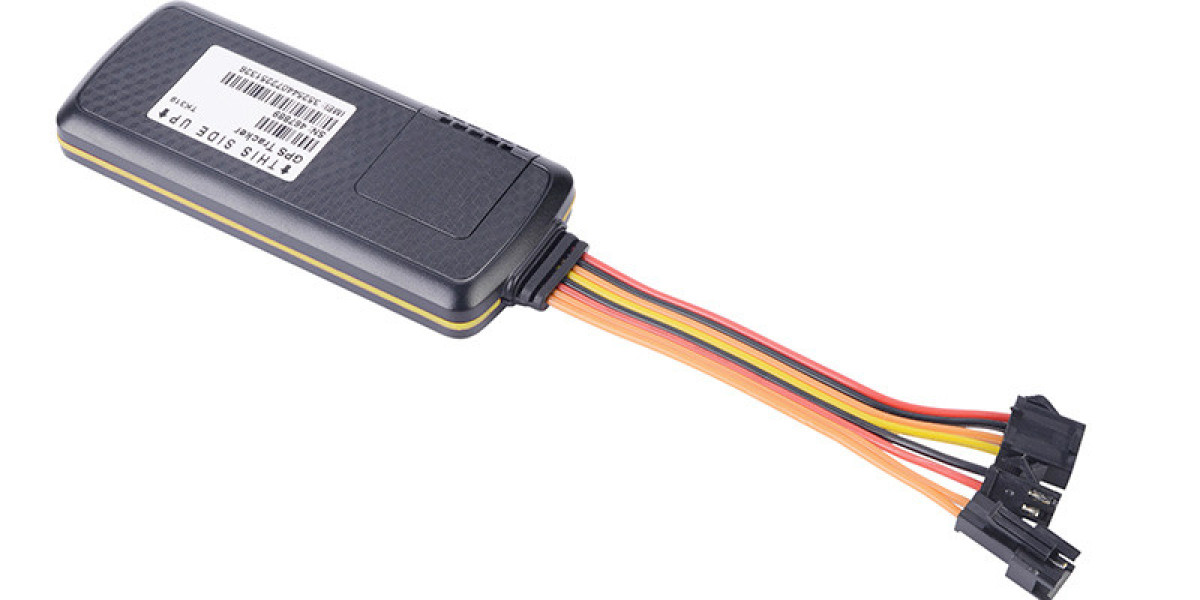

Is there any track sos that does not require a transit platform

By 420dcxyz

Is there any track sos that does not require a transit platform

By 420dcxyz