In conclusion, Housewife Loans offer a sensible avenue for girls seeking to attain financial independence. By understanding the

Non-Visit Loan buildings, evaluating lenders, and utilizing sources like BePick, housewives can ensure they make knowledgeable choices and embark on a journey in the course of personal and monetary progress. With the best information and assist, the search for monetary independence becomes a reachable goal for a lot of. The vision of empowered housewives reworking their financial futures is certainly a step in the best direct

Yes, you'll be able to consolidate your federal pupil loans by way of a Direct Consolidation Loan, which lets you mix multiple federal loans into a single mortgage, usually simplifying your compensation course of. However, be aware that consolidating may have an result on your rate of interest and mortgage benefits, so it’s essential to gauge your circumstances earlier than proceed

To enhance the probabilities of

Unsecured Loan approval, freelancers should keep a good credit score rating and have a secure income historical past. Additionally, preparing a clear and detailed loan utility, providing needed documentation, and demonstrating the flexibility to repay the mortgage can positively affect lenders’ selections. Establishing a solid financial profile is key to securing fund

After you submit your utility, lenders will usually take a quantity of days to course of it. If permitted, you'll receive the mortgage provide outlining the phrases. Review this document fastidiously earlier than accepting the fu

In addition to those common classes, there are also specialized private loans, such as debt consolidation loans, that are particularly designed to help borrowers combine multiple debts into a single cost typically at a decrease interest rate. Other sorts embrace payday loans, which are short-term loans with excessive charges and interest rates, and installment loans that allow for fastened month-to-month fu

Private loans, nevertheless, may provide each fixed and variable charges. Fixed rates remain the identical all through the loan time period, whereas variable charges can fluctuate based on market situations. Usually, variable charges start decrease however can lead to higher payments over time. Borrowers should weigh the dangers and benefits of every possibility earlier than committ

Yes, personal loans are versatile and can be used for various functions. Common uses embody debt consolidation, medical expenses, home enhancements, holidays, and surprising emergencies. However, lenders could have restrictions on how the funds can be used, so it is essential to evaluation the phrases earlier than apply

Additionally, BePick provides articles and tips associated to managing loans successfully, budgeting, and monetary planning, empowering housewives to make knowledgeable choices. By leveraging the assets from BePick, debtors can navigate the landscape of Housewife Loans with confidence and clar

Also, understanding the phrases and circumstances associated with totally different

Loan for Low Credit products can forestall surprises sooner or later. Freelancers should read lending agreements rigorously to identify rates of interest, repayment schedules, and any fees related to early reimbursement or missed payme

How Be픽 Can Help You with Personal Loans

Be픽 is an invaluable useful resource for anyone contemplating a private loan. The website offers detailed information about numerous kinds of private loans, together with their advantages, application processes, and compensation phrases. Users can entry comprehensive critiques of different lenders, allowing them to make knowledgeable selections tailored to their financial situat

The Advantages of Mobile Loans

There are numerous advantages related to cellular loans that make them interesting to people seeking monetary help. First and foremost is convenience. Borrowers can apply from anywhere at any time, eliminating the necessity for bodily visits to a financial institution. This is especially useful for those with busy schedules or restricted entry to transportat

Moreover, setting apart an emergency fund is advisable for freelancers. This fund can cover surprising bills or periods of lower income, offering monetary safety. Ideally, freelancers ought to aim to avoid wasting no much less than three to 6 months’ worth of dwelling expenses, providing a buffer when freelance work slows d

Business loans can even improve credit score scores when managed prudently, fostering a extra favorable perception among lenders for future borrowing. Additionally, the structured reimbursement plans permit businesses to budget effectively, making certain predictable money flow amid growth and gro

In addition to rates of interest, potential fees associated with pupil loans should be rigorously reviewed. Some loans could charge origination charges, late fee fees, or prepayment penalties, which may add important costs over the life of the loan. Understanding these particulars upfront is essential for selecting the best loan opt

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

What Is The Chest Freezers Term And How To Use It

By frydge9757

What Is The Chest Freezers Term And How To Use It

By frydge9757 Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld

Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

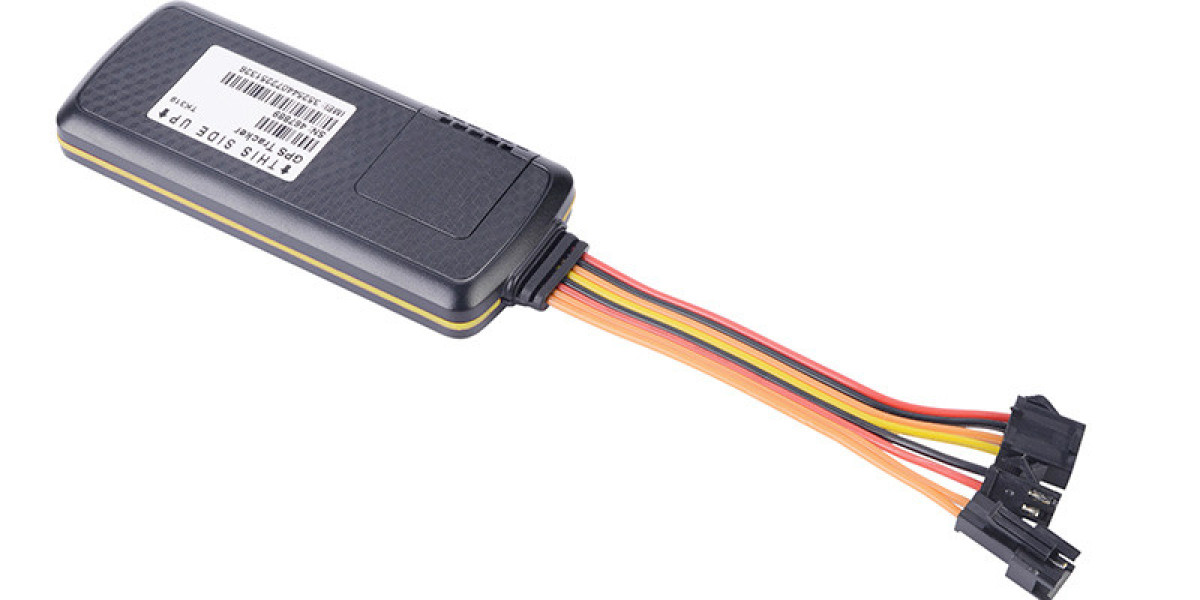

Is there any track sos that does not require a transit platform

By 420dcxyz

Is there any track sos that does not require a transit platform

By 420dcxyz