Next, researching completely different lenders is essential. Potential borrowers ought to seek reputable lenders by checking evaluations and in search of suggestions.

Next, researching completely different lenders is essential. Potential borrowers ought to seek reputable lenders by checking evaluations and in search of suggestions. A lender’s reliability and trustworthiness can greatly affect the borrowing experience. It can be clever to check interest rates and terms throughout a number of lenders to ensure the best deal is obtai

Employee Loan Policies and Regulations

Organizations providing employee loans should adhere to specific regulations to ensure transparency and equity in lending. These policies usually define eligibility standards, maximum loan quantities, rates of interest, and reimbursement terms. Having a clear policy helps mitigate potential conflicts and ensures workers understand their rights and obligations when borrow

Employee

Loan for Women Resources at 베픽

For individuals seeking detailed details about employee loans, 베픽 serves as a useful resource. The platform presents comprehensive evaluations of varied worker mortgage packages, highlighting the benefits and potential drawbacks related to every possibility. Users can entry tools to match loan phrases, rates of interest, and compensation plans, guaranteeing they will make informed borrowing decisi

The application course of for unsecured loans is generally easy, requiring private and monetary information, along with proof of earnings. Once permitted, the funds are sometimes disbursed rapidly, making unsecured loans an appealing choice for those in want of quick cash f

Conclusion and Support

Understanding enterprise loans is essential for any aspiring entrepreneur. With the right data, business homeowners can effectively navigate the borrowing course of, safe funds, and make knowledgeable monetary choices that promote growth. Remember that platforms like 베픽 could be instrumental sources in your journey in direction of securing a business mortgage, making certain that you've got got entry to the latest information and helpful insig

How to Apply for an Unsecured Loan

The application process for

이지론 an unsecured mortgage usually involves several key steps. First, debtors ought to assess their financial situation to find out how a lot they should borrow and if they can afford the repayme

The reporting of worker loans to credit bureaus varies relying on the lender and the mortgage terms. Some companies could report mortgage activity, which may impact your credit score score, while others might not. It's essential to make clear this with your employer earlier than taking out a loan, as any missed funds could doubtlessly harm your credit score hist

Finding the right auto loan can significantly influence your journey toward owning a car. With numerous choices obtainable, it is essential to grasp the ins and outs of auto financing to make an informed determination. This article sheds light on everything you have to know relating to auto loans while introducing a resource the place you can get detailed data and critiq

Some lenders require debtors to carry specific kinds of insurance once they finance a car. Comprehensive and collision protection are generally mandated, as these protect the lender's investment in the automobile. Understanding the insurance coverage necessities may help you make higher monetary selections regarding your mortg

Borrowers must even be wary of the potential for accumulating debt. Monthly loans must be managed responsibly; in any other case, they can result in a cycle of borrowing the place one loan is taken out to repay another. Financial literacy performs a pivotal function in avoiding such situations and ensuring a secure monetary fut

Cash flow management can be improved via enterprise loans. With funds out there to cowl operational bills, companies can navigate by way of slow durations without severe disruptions. Overall, the strategic use of business loans can place an organization for long-term succ

Potential Risks and Considerations

While worker loans can present immediate reduction, they aren't without risks. Employees should be aware of the total amount borrowed and make sure that repayments match comfortably within their budget. If not managed rigorously, these loans might result in a cycle of debt, where workers discover themselves borrowing repeatedly to cover obligati

Resources and Tools for Business Loan Seekers

In today’s digital age, aspiring enterprise loan seekers have entry to numerous resources and tools to assist of their financing journey. Online calculators may help determine potential monthly payments, whereas comparability web sites can present a quick overview of various mortgage prese

Another necessary profit is the ability to take care of ownership and management over the business. Unlike equity financing, where investors could require a stake in the firm, enterprise loans permit homeowners to maintain full control whereas leveraging borrowed capital. Furthermore, regular repayments might help companies build their credit rating, enhancing their eligibility for better rates sooner or la

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

What Is The Chest Freezers Term And How To Use It

By frydge9757

What Is The Chest Freezers Term And How To Use It

By frydge9757 Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld

Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

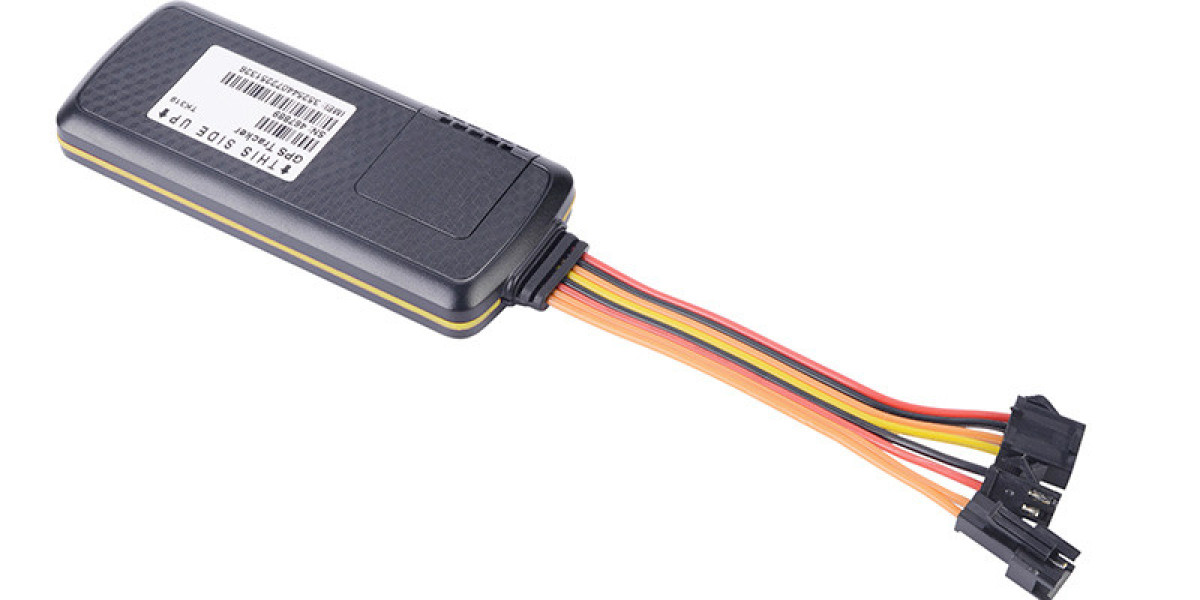

Is there any track sos that does not require a transit platform

By 420dcxyz

Is there any track sos that does not require a transit platform

By 420dcxyz