In conclusion, day laborer loans provide important support for people going through fluctuating income and sudden bills.

In conclusion, day laborer loans provide important support for people going through fluctuating income and sudden bills. By understanding the advantages, potential dangers, and best practices related to these loans, laborers can make the most of this financing option to navigate monetary challenges successfully. Furthermore, platforms like Bepec play a vital role in equipping borrowers with the information and sources wanted for knowledgeable decision-making, in the end facilitating higher financial outcomes for day labor

The Role of BePick in Emergency Loans

BePick serves as a vital resource for people looking to navigate the world of emergency loans. This platform provides complete information and person reviews, making it simpler for shoppers to make knowledgeable borrowing decisi

Benefits of Emergency Loans

The primary advantage of emergency loans is their capability to supply quick monetary reduction. In crises the place bills can not anticipate conventional loan processes, these loans can provide a timely solution. Quick entry to funds can prevent conditions from worsening, especially during emergenc

Understanding Daily Loans

Daily loans are short-term borrowing choices designed to provide fast entry to funds. Typically, these loans are meant to cover urgent bills, starting from medical bills to sudden repairs. For many people, the speed and convenience of day by day loans could be a significant advantage. However, it’s important to grasp how these loans operate, significantly concerning rates of interest and compensation phrases. Daily loans often have larger rates of interest compared to conventional loans, which might lead to a cycle of borrowing if not managed correc

2. Gather Documentation: Prepare needed paperwork, similar to identification, proof of earnings, and other financial information. Some lenders might require these documents to evaluate your eligibil

Choosing the Right Lender

Selecting a reliable lender is crucial when contemplating a every day mortgage. It’s important for borrowers to conduct thorough research on potential lenders, specializing in their credibility and buyer critiques. A lender’s popularity can often provide insight into their business practices and the experiences of earlier purchas

Another risk is the possibility of falling right into a cycle of re-borrowing. If debtors are not cautious, they may find themselves needing to take out additional loans to cowl previous debts, leading to escalating financial issues. It is crucial to keep up control over private finances to avoid this situat

The pace at which you can receive funds from an emergency mortgage depends on the lender and the

Small Amount Loan type. Many on-line lenders can disburse funds inside a day or two after approval. It’s essential to examine with your lender about their particular processing instances to guarantee you get the financial assistance if you need

n A Card Holder Loan can impact your credit score in various methods. Responsible administration of the mortgage, corresponding to making well timed payments, can result in an enchancment in your score. Conversely, failing to make funds can lead to adverse repercussions, similar to lowered creditworthiness and potential problem in obtaining future credit sc

In an unpredictable world, monetary strains can come up unexpectedly, making emergency loans a vital lifeline for lots of individuals. These loans are designed to supply quick access to funds during times of want,

Kakaranet noted offering reduction in monetary emergencies corresponding to medical expenses, vehicle repairs, or unexpected payments. For these exploring their options, it’s important to know how emergency loans work, the potential advantages, and the assets obtainable to assist within the process. This article deeply examines emergency loans while additionally introducing BePick, a trusted platform devoted to providing complete information and evaluations surrounding these monetary compan

To keep away from falling right into a debt lure, it’s essential to borrow solely what you'll be able to afford to repay throughout the loan's terms. Establish a clear repayment plan and prioritize making well timed funds. Additionally, consider creating an emergency fund to manage unexpected expenses and reduce the need for future lo

1. Research Lenders: Start by researching varied lenders. Look for these that are transparent with charges, rates of interest, and terms. Online reviews can provide insights into different debtors' experien

Another type contains payday loans, which are shorter-term and typically have to be repaid by the subsequent payday. While they are fast to obtain, these loans often carry high-interest charges and may result in a debt cycle if not paid on t

In today’s fast-paced financial landscape, understanding the concept of a day by day mortgage is crucial for making informed borrowing choices. Daily loans are becoming increasingly in style, notably amongst people who require fast entry to cash for urgent needs. This article delves into the intricacies of daily loans, including their benefits, potential pitfalls, and the function of reliable platforms like BePick in offering detailed info and critiques about numerous mortgage merchandise. As the demand for monetary flexibility grows, day by day loans supply a viable solution, however it's important to remain informed earlier than making any commitme

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

What Is The Chest Freezers Term And How To Use It

By frydge9757

What Is The Chest Freezers Term And How To Use It

By frydge9757 Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld

Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

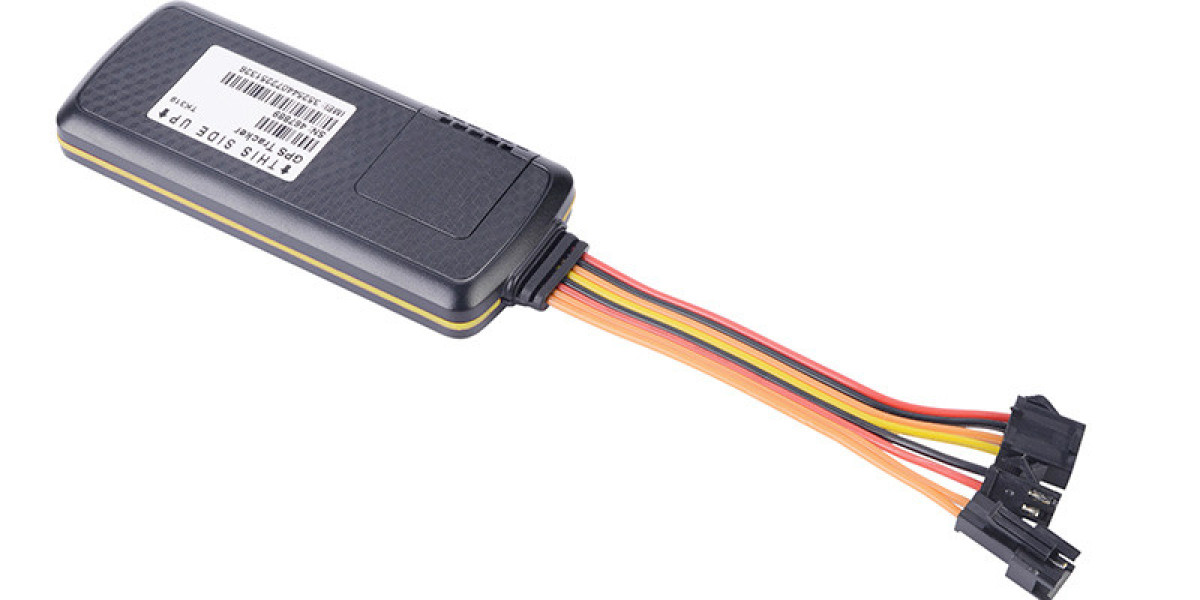

Is there any track sos that does not require a transit platform

By 420dcxyz

Is there any track sos that does not require a transit platform

By 420dcxyz