Types of Student Loan Repayment Plans

Understanding repayment choices is simply as very important as knowing the means to acquire pupil loans.

Types of Student

Personal Money Loan Repayment Plans

Understanding repayment choices is simply as very important as knowing the means to acquire pupil loans. Federal scholar loans include a variety of repayment plans tailor-made to accommodate different monetary circumstances. The commonplace compensation plan usually requires fastened

Monthly Payment Loan payments over ten years. However, for individuals who might experience monetary hardship, various plans similar to Income-Driven Repayment (IDR) plans can be fo

The Application Process for Real Estate Loans

The software course of for a real estate mortgage can appear daunting, however understanding the steps can streamline the experience. The first stage usually includes gathering financial documentation, corresponding to income statements, credit stories, and tax returns, to demonstrate financial stability to lend

Another false impression is that making use of for a loan will negatively impact a credit score rating. While it’s true that multiple onerous inquiries can have an result on a credit rating, accountable borrowing and timely repayments can improve one's credit score profile over t

Finally, totally reviewing mortgage terms and conditions before signing is essential. Borrowers ought to pay shut attention to the rates of interest, repayment phrases, and any potential charges associated with the mortgage. Understanding the full value of borrowing helps avoid surprises down the r

In addition to budgeting, consider making payments whereas nonetheless in school, especially when you have unsubsidized loans. Any payments made can significantly reduce the whole amount due whenever you graduate. Furthermore, keeping in touch together with your mortgage servicer can provide you with sources for deferment or forbearance if you find yourself struggling to make fu

The user-friendly interface makes it straightforward to entry essential data rapidly. Whether it's understanding widespread pitfalls when making use of for a mortgage or finding potential alternate options, 베픽 is indispensable for housewives trying to enhance their financial liter

The rise of monetary independence among housewives has led to an elevated curiosity in specialised loan merchandise, often recognized as Housewife Loans. These loans cater specifically to the distinctive needs of homemakers, offering them with the chance to entry funds for private initiatives, educational pursuits, and even business ventures. As the panorama of economic services evolves, housewives are finding a voice in this financial arena, permitting them to contribute to their household's earnings or begin one thing entirely new. Websites like 베픽 are pivotal on this journey, providing priceless assets, critiques, and insights into the world of Housewife Lo

How to Find the Right Lender

Finding an appropriate lender is essential for a profitable borrowing experience. Many options are available, including traditional banks, credit unions, and online lenders. Each lender has unique offerings, so it’s advisable to match charges, phrases, and the general borrowing experie

What Are Pawnshop Loans?

Pawnshop loans are short-term loans secured by collateral, usually gadgets of worth corresponding to jewellery, electronics, or useful collectibles. When you bring an item to a pawnshop, the pawnbroker assesses its value and presents a loan amount based mostly on that appraisal. This can range from a couple of dollars to several thousand, depending on the item’s va

Most pawnshops settle for a variety of things including jewelry, electronics, musical devices, and collectibles. However, the particular items accepted can vary by retailer. It’s advisable to call ahead or examine the pawnshop’s web site for a listing of acceptable obje

Finally, borrowers should remain in communication with their lenders if any reimbursement challenges arise. Many lenders might offer versatile choices or solutions to help manage monetary difficulties, thereby preventing opposed impacts on credit score scores or mortgage agreeme

In some cases, debtors may qualify for packages that permit for lower down funds, notably first-time homebuyers. However, these packages often come with stricter credit score necessities and potential private mortgage insurance (PMI) pri

Another main consideration is the loan’s function. Clearly defining why you want a loan improves your probabilities of securing one. Additionally, lenders typically choose businesses that can articulate a solid plan for utilizing the funds successfu

Navigating the world of scholar loans may be daunting for so much of college students and their households. Understanding various sorts of loans, interest rates, repayment choices, and borrowing limits is important not just for financial planning but for making certain a clean instructional journey. As the costs of training proceed to rise, informed decision-making about pupil loans turns into crucial to avoid future financial burdens. This article will break down the important elements of student loans, from the means to apply to the intricacies of managing compensation after graduation, all while highlighting a useful resource: 베

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

What Is The Chest Freezers Term And How To Use It

By frydge9757

What Is The Chest Freezers Term And How To Use It

By frydge9757 Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld

Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

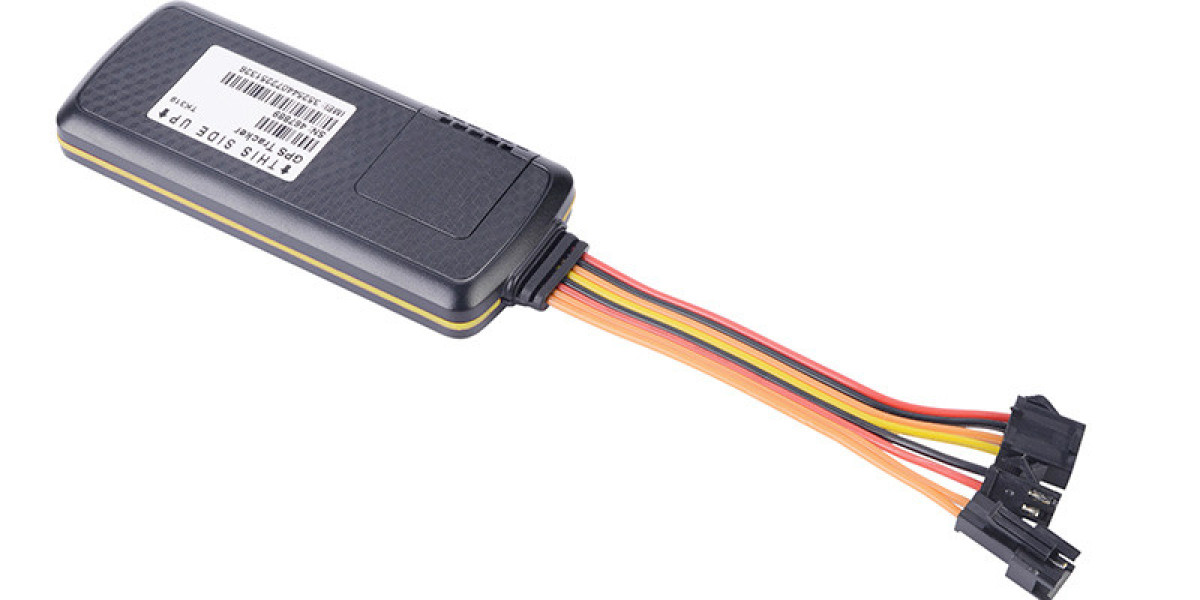

Is there any track sos that does not require a transit platform

By 420dcxyz

Is there any track sos that does not require a transit platform

By 420dcxyz