2. Payday Loans: Intended for quick cash needs, payday loans are short-term and sometimes have high-interest rates.

2. Payday Loans: Intended for quick cash needs, payday loans are short-term and sometimes have high-interest rates. Borrowers should repay the

Loan for Unemployed by their subsequent payday, which may lead to a cycle of debt if not managed fastidiou

Potential Risks Involved

Despite their benefits, employee loans usually are not with out risks. Employees would possibly really feel compelled to take out loans for unnecessary bills, leading to a cycle of debt. This is especially concerning if employees depend on these loans regularly, probably harming their financial stability in the lengthy t

Yes, there are options to every day loans, including personal loans, bank cards, or borrowing from pals or family. Each choice has its personal advantages and disadvantages, so it's crucial to consider your monetary circumstances and compare different merchandise before making a alternat

Many lenders permit early repayment of Additional Loans with out penalties, but this varies by lender. It’s essential to evaluate your mortgage settlement and examine for any specific clauses related to early repayment. Paying off a loan early can save you on curiosity costs, so if your lender permits it, this can be a financially beneficial techni

Choosing the Right Card Holder Loan

When choosing a Card Holder Loan, it’s essential to compare offers from multiple lenders. Look for financial institutions that provide transparent terms and conditions, in addition to aggressive interest rates. Many lenders will permit you to verify your eligibility without impacting your credit sc

A daily loan is a short-term financial product designed to provide fast entry to cash for surprising bills or emergencies. The software process is normally fast and simple, allowing users to obtain funds within a day. However, it is very important evaluation the related rates of interest and repayment schedules fastidiously to avoid financial pitfa

BePick offers a user-friendly interface that guides you through several sorts of loan calculators and their respective features. From mortgage to personal loans, BePick covers a broad range of matters, making certain that customers can find the precise software they want for their monetary calculati

Furthermore, a office that prioritizes worker well-being may appeal to top expertise striving for not only monetary stability but also a supportive work environment. As such, employers ought to think about integrating employee mortgage applications into their benefits bundle to nurture a wholesome workplace culture and retain useful st

Additionally, day by day loans often have much less stringent qualification standards, making them accessible to individuals with less-than-perfect credit score histories. This inclusivity is critical for individuals who could not qualify for standard loans and wish monetary support throughout robust occasions. As a end result, daily

Loan for Credit Card Holders loans can function a necessary financial tool for many people looking for short-term reduction without present process a lengthy approval proc

In addition to reviews, Be Pick presents varied articles and guides on financial literacy, empowering customers to navigate their monetary journeys with confidence. The platform also allows users to check rates and terms across totally different lenders, streamlining the process of choosing a loan that meets their wants successfully. Whether you are a first-time borrower or somebody with expertise, Be Pick goals to enhance your understanding of every day loans, ensuring you make the right decisi

With an in depth library of articles on financial literacy, Be픽 equips its readers with the information necessary to make knowledgeable decisions. Their user-friendly interface permits users to explore numerous choices related to Card Holder Loans and entry clear critiques that inform about completely different lenders and their phra

Effective Use of Daily Loans The key to utilizing daily loans wisely lies in having a structured plan for reimbursement. Before taking out a loan, borrowers should carefully assess their present monetary obligations and decide how the new loan fits into their budget. Having a transparent view of future bills can help mitigate the risk of defaulting on repayme

Additionally, utilizing day by day loans correctly means profiting from them for true emergencies somewhat than discretionary spending. This method ensures that borrowed funds go towards resolving quick financial challenges and helps maintain long-term financial well being. Remember, responsible borrowing is crucial when it comes to protecting your credit score and securing a stable monetary fut

Card Holder Loans have emerged as a well-liked financing option for a lot of individuals. They present quick access to money without the need for in depth credit score checks, making them appealing for those in need of quick funds. By leveraging the present credit score obtainable on their credit cards, borrowers can benefit from relatively low rates of interest compared to traditional private loans. In this text, we are going to delve into the intricacies of Card Holder Loans, explore their benefits and limitations, and highlight how you can find reliable details about them on the Be픽 webs

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

What Is The Chest Freezers Term And How To Use It

By frydge9757

What Is The Chest Freezers Term And How To Use It

By frydge9757 Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld

Revolutionizing Hospital Navigation with ZIGO Sign's Digital Signage Solutions

By newsworld Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

Accident Injury Lawyers Near Me: 11 Thing You're Forgetting To Do

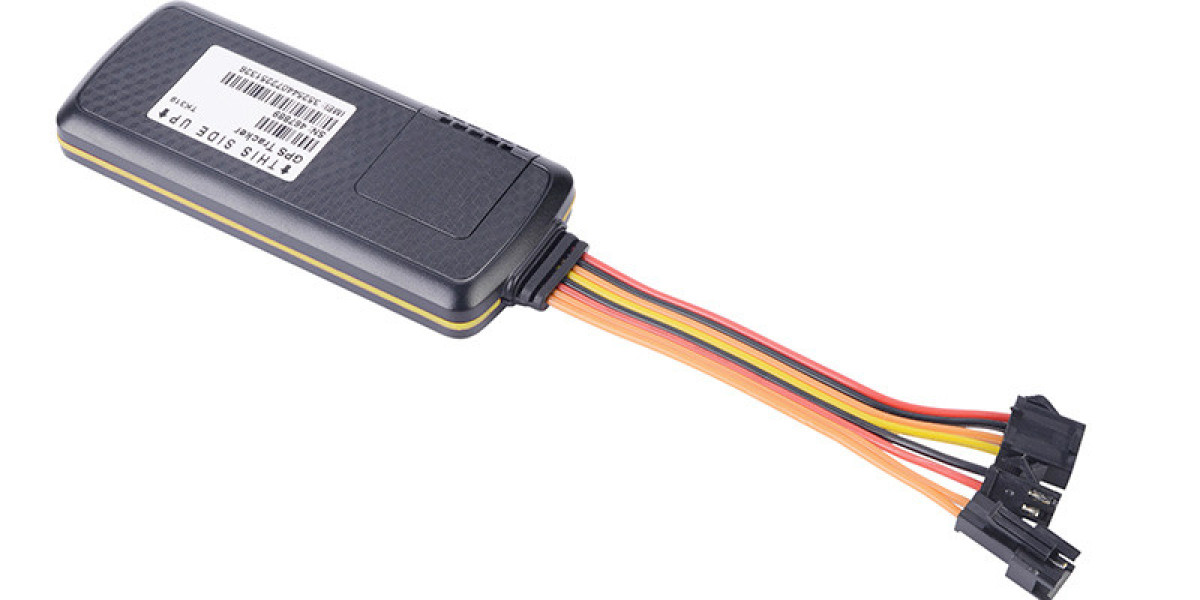

Is there any track sos that does not require a transit platform

By 420dcxyz

Is there any track sos that does not require a transit platform

By 420dcxyz