The nature of day labor work usually comes with income unpredictability. Day laborers might expertise weeks with important earnings adopted by periods of little or no work.

The nature of day labor work usually comes with income unpredictability. Day laborers might expertise weeks with important earnings adopted by periods of little or no work. This fluctuation can result in **financial uncertainty**. Day laborer loans provide a buffer throughout these lean instances, helping individuals manage household bills with out falling into debt traps or depleting savi

When making use of for an auto mortgage, lenders will assess your credit score, earnings, and debt-to-income ratio to determine how a lot they are keen to lend and at what interest rate. A good credit score often results in decrease interest rates, which can save borrowers important quantities over the lifetime of the l

After submission, lenders typically conduct a quick evaluation of your utility, which typically contains verifying your id and assessing your financial health. If accredited, you probably can anticipate funds to be deposited into your account within a matter of hours. This velocity is probably certainly one of the defining options that make these loans so enticing to debtors in pressing need of fu

Additionally, these loans often require much less documentation, enabling people with no permanent address or a gentle earnings to apply for financial help. This inclusivity is essential for laborers who traditionally face barriers when attempting to safe loans through standard ba

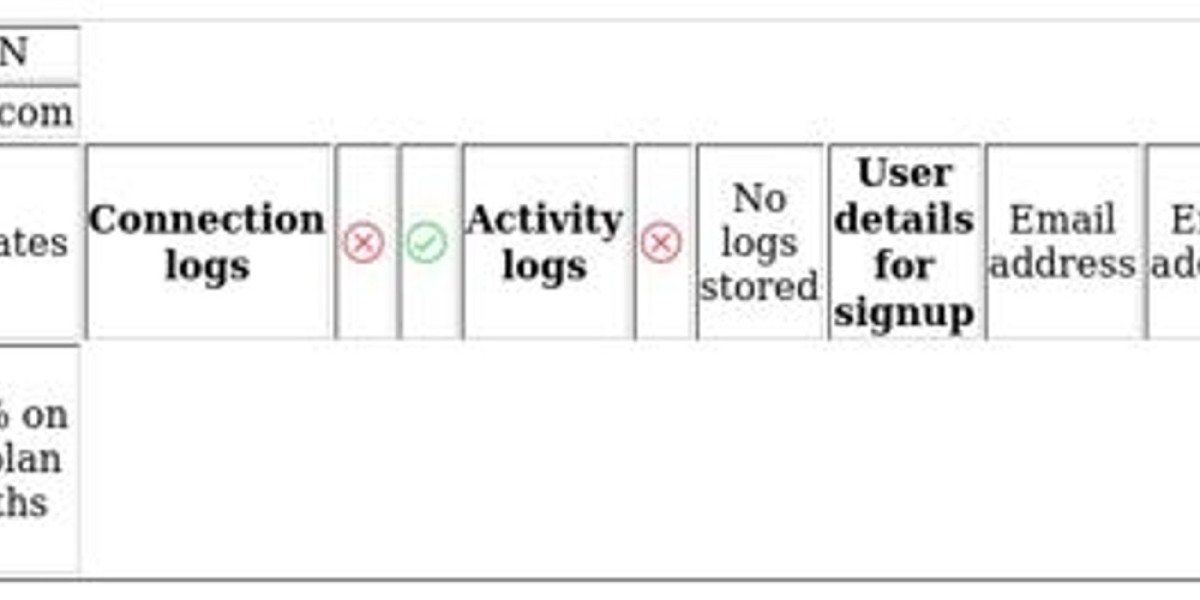

No-document loans usually rely on various types of verification, similar to credit scores or property value determinations. These criteria assist lenders assess the chance concerned in granting the mortgage whereas minimizing the necessity for traditional paperwork. However, it’s essential to grasp that while the method may be convenient, debtors usually face trade-offs, corresponding to higher rates of interest or decreased mortgage quantities compared to more traditional lo

Understanding Loan Terms and Conditions

Before signing any auto mortgage agreement, it's essential to thoroughly perceive the terms and situations laid out by the lender. Key parts to evaluate include the annual percentage rate (APR), mortgage term, monthly payment quantity, and any charges associated with the l

Finally, it's important to keep away from taking up a loan that exceeds your finances. Always consider your present monetary obligations to ensure you can handle your auto mortgage funds without straining your fu

Another false impression is that the method solely favors high-income people or these with wonderful credit scores. In reality, many lenders consider a broader set of criteria, making these loans accessible to a diverse vary of borrow

Moreover, day laborer loans might help individuals build credit score historical past. When repaid on time, they provide a possibility for employees to improve their credit score scores, which can result in higher loan phrases in the fut

The platform empowers customers to match totally different

Loan for Unemployed presents, method lenders armed with information, and in the end make informed decisions that align with their financial objectives. With user evaluations and ratings, potential debtors can gauge the reliability and popularity of lenders before making commitme

Common Misconceptions About Day Laborer Loans

There are a number of misconceptions surrounding day laborer loans that can result in confusion amongst prospective borrowers. One common fable is that these loans are only for people with poor credit score. While many lenders do consider credit history, quite a few options remain accessible for borrowers with varying credit score sco

Potential Drawbacks

Despite their attraction, 24-hour loans do come with potential drawbacks. One of essentially the most important issues is the interest rates associated with these loans. Because they are typically unsecured and contain greater risk for lenders, interest rates can be exorbitant. Borrowers ought to fastidiously evaluate phrases to keep away from financial strain because of high compensation co

Common Pitfalls to Avoid

Many borrowers fall into widespread traps when securing an auto loan. One main pitfall is focusing solely on the month-to-month fee without contemplating the general price of the loan. A lower month-to-month payment usually means an extended mortgage term, which may end up in higher curiosity co

Additionally, there are specialized loans corresponding to lease buyouts, where an choice to buy a leased vehicle is financed. Understanding these mortgage varieties can help borrowers make knowledgeable choices that finest match their ne

Improving your credit rating is one efficient method to enhance your chances of

Loan for Credit Card Holders approval. Additionally, demonstrating stable earnings or presenting collateral may be useful. Always check the lender's particular necessities for a more focused strat

Additionally, watch for fees that may include the mortgage. Some lenders may cost origination fees, late cost charges, or prepayment penalties. Always read the fantastic print and ask questions if any terms are unclear to prevent unexpected prices la

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

Guide To Best Rated Bunk Beds: The Intermediate Guide The Steps To Best Rated Bunk Beds

Luxury Meets Tradition the Best High-End Experiences in Kuala Lumpur

By Hafiza fil

Luxury Meets Tradition the Best High-End Experiences in Kuala Lumpur

By Hafiza fil Best 1Win Promo Code for Quick Wins in 2025

Best 1Win Promo Code for Quick Wins in 2025

BetWinner Promo Code for Easy Bonus Withdrawals: LUCKY2WIN

BetWinner Promo Code for Easy Bonus Withdrawals: LUCKY2WIN

What Is The Chest Freezers Term And How To Use It

By frydge9757

What Is The Chest Freezers Term And How To Use It

By frydge9757